Invest Smarter: Mango Farmland vs Real Estate – Which Grows Your Wealth?

Introduction

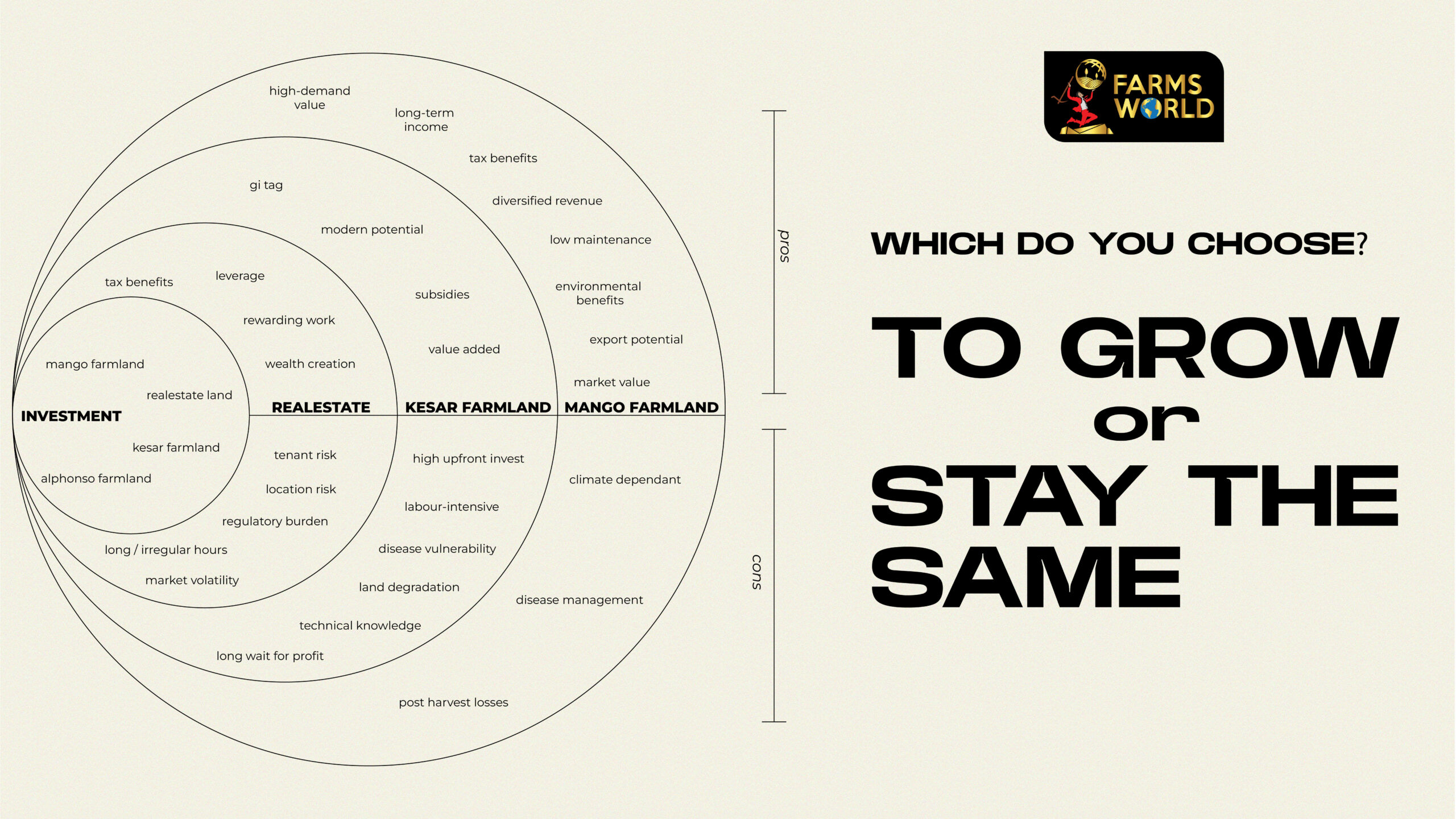

In today’s investment landscape, you’re often faced with a difficult choice: play it safe with traditional real estate or venture into high-growth opportunities like farmland. At Farms World, we believe in helping investors make informed decisions that lead to long-term wealth and sustainable impact. This blog breaks down a visual framework comparing Real Estate, Kesar Farmland, and Mango Farmland—helping you answer one powerful question:

“Do you want to grow or stay the same?”

Understanding the Investment Categories

The image above presents three core investment categories inside concentric circles. The further out you go, the higher the growth potential—and the complexity.

1. Investment (Innermost Layer)

Basic land investments, such as

- Mango Farmland

- Real Estate Land

- Alphonso Farmland

- Kesar Farmland

These offer traditional value but often come with market volatility, long harvest cycles, or tenant risk.

2. Real Estate (Mid Layer)

Real estate offers:

- Leverage opportunities

- Regular income (rent)

- Wealth creation

- But also brings regulatory burden and location risk

It’s familiar, safe—but is it still the most profitable?

Why Farmland? The Shift Towards Agricultural Investment

At Farms World, we’re seeing a shift in investor mindset—from static income to productive land ownership. Enter:

3. Kesar Farmland

Known for its

- Value-added potential

- High upfront investment

- Rewarding seasonal returns

- Tax benefits

However, it requires labor-intensive management and expertise in disease control and land care.

The Star Performer: Mango Farmland

Positioned at the outermost ring in the visual, the mango farmland combines

High Market Value

Export Potential

Environmental Benefits

Long-Term Passive Income

Tax Incentives

Diversified Revenue Streams

But why is Mango Farmland booming?

Mangoes, especially from GI-tagged regions like Alphonso and Kesar zones, fetch premium prices both locally and internationally. With increasing demand and climate suitability in India, mango farmland is a future-proof asset.

Risks to Know (and Manage)

No investment is perfect. Mango farming requires:

- Climate resilience

- Disease management

- Post-harvest storage planning

However, with proper support — such as our turnkey solutions at Farms World — these risks are manageable and well worth the potential upside.

Farms World: Your Partner in Growth

We don’t just sell land — we guide you with:

- Expert consultations

- Farmland selection based on soil, water, and climate

- Legal assistance

- Farm management and yield tracking

Whether you’re a first-time investor or an experienced grower, we help you enter the agricultural space confidently and profitably.

Conclusion: The Real Question

So, which do you choose?

To grow with Mango Farmland, future-focused revenue, and environmental returns.

🪵 Or stay the same with real estate, low risk but limited innovation.

At Farms World, we believe growth is the only direction that matters. Contact us today to discover how a mango farm can reshape your financial future.